With weed becoming more popular in American culture in the last decade or so, there have been a lot of pro-cannabis arguments that have made their way to congress and other legislative bodies. There are a ton of good reasons for why cannabis should be legal, and a lot of it involves compassionate healthcare for people that need alternative treatment options.

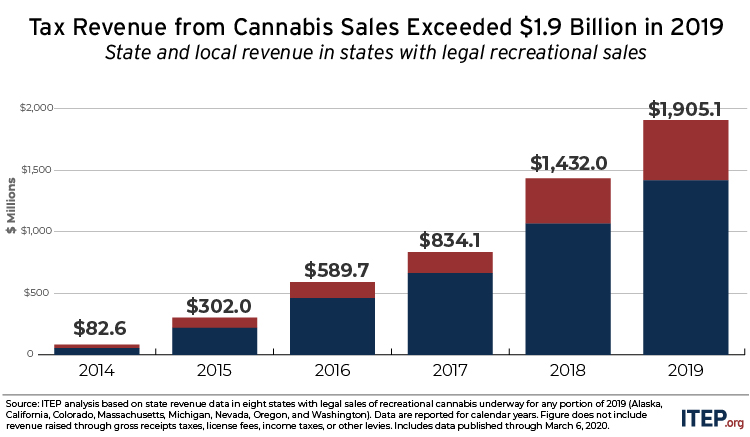

Prescription medications like opioids and other painkillers are not necessarily getting the job done in our society. However, it is also fair to make the assumption that governing bodies really only care about themselves, and to that extent, money. That is why this is one of my favorite reasons for legalizing cannabis in the United States. The tax revenue that can be pulled from the cannabis industry is enormous. We have already seen how important marijuana is to the American public, and that it has been proven to be in steady demand even through the pandemic. One of the huge benefits that states get from legalizing weed programs is the tax revenue.

Not long ago was the biggest year for the cannabis industry in our country, right until recently came along and broke all of those records. The point is that the marijuana industry makes a lot of financial sense in terms of state benefits. Most states are struggling to allocate money around in their budgets to deal with repercussions from the pandemic and subsequent recessions that followed, but many of the states that have legalized marijuana are realizing huge gains from the industry and are able to put that money to good use. Today, I wanted to talk about some of the states with the highest cannabis tax revenues and talk a little about what they are doing with that money.

Usually, the first step for a state that wants to get involved with marijuana for its residents is to come up with a medical marijuana program. However, this takes a lot of time, energy, and money. States spend millions of dollars in order to effectively launch their medical marijuana programs. The cost of getting everything organized and hiring all the necessary people to license and regulate the industry is expensive. Furthermore, it can take some time before the state actually makes a return on their investment.

However, it is always the case that the state makes their money back, and then some. Can the potential tax revenue influence a state’s decision to legalize marijuana? Absolutely! In fact, legalizing adult use marijuana is generally the next step that states take in the mairjauna journey. States that legalize cannabis see substantial increase in tax revenues, and it is totally possible that this can influence the decision to actually legalize it. After all, why wouldn’t it? State governments love money. So let’s talk about some of the states with the highest cannabis tax revenues. Do you think you’d be able to guess the top 3 states?

If you guessed California, Colorado, and Washington, you would be correct. These states realize massive tax revenues from marijuana, and all 3 states have legalized medical use of weed. So what are some of the things that this tax revenue can be used for? Well, much of the money can be used to fund state medicaid programs, as well as deposited into the department of social and health services.

The money can also be used to fund school systems, like the case in the state of Oregon. Who would have thought that your little kid would be using school supplies funded by the sales of marijuana? I hope that this is insightful for you!